Short Call Risk Profile

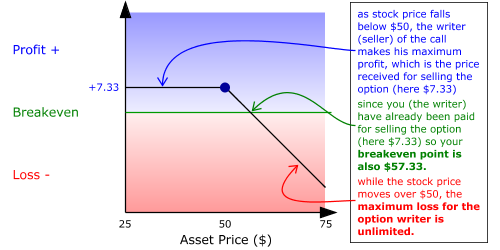

For every call that you buy, there is someone else on the other side of the trade. The seller of an option is called an option writer. Logic and common sense

tell us that the option seller's risk profile must be different to that of the option buyer.

|

Stock Price

|

$56.00

|

|

Call Premium

|

7.33

|

|

Exercise Price

|

50.00

|

|

Time to Expiration

|

2 months

|

Remember that we already discussed the implications of selling an option - here's a reminder:

Selling (naked) imposes the obligation

-

Selling a call obliges you to deliver the underlying asset to the option buyer.

-

Selling options naked (ie when you have not bought a position in the underlying instrument or an option to hedge against it) will give you an unlimited risk profile. The continuous

downward diagonal line is generally a bad sign because it means unlimited potential risk.

-

Combined with the fact that you are obliged to do something, this is not an ideal strategy for the inexperienced, however it can be combined with other positions to create a new strategy.