Long Put Risk Profile

So, now you know what long and short calls look like, let's look at the risk profile of a put option.

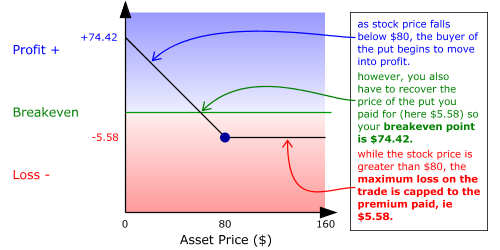

We already know that a put option is the right to sell an asset. Logically, this suggests that the put option risk profile direction will be the opposite to that of calls or

buying the asset itself. So, again, let's have a look at an example:

|

Stock Price

|

$77.00

|

|

Put Premium

|

5.58

|

|

Exercise Price

|

80.00

|

|

Time to Expiration

|

4 months

|

Remember that:

Buying gives you the Right

-

Buying a put gives you the right, not the obligation to sell an underlying instrument (eg a share).

-

When you buy a put you are not obligated to sell the underlying instrument - you simply have the right to do so at the strike price.

-

Your maximum risk, when you buy an option, is simply the price you paid for it.

-

Your maximum reward is uncapped. With long puts your reward is uncapped to the downside, ie the strike price less the put premium. In this example

that is: 80.00 - 5.58 = 74.42.

For every put that you buy, there is someone else on the other side of the trade. The seller of a put option is will have a different risk profile to that of the put option buyer.